This page provides additional information related to topics covered by the Bellingham Plan.

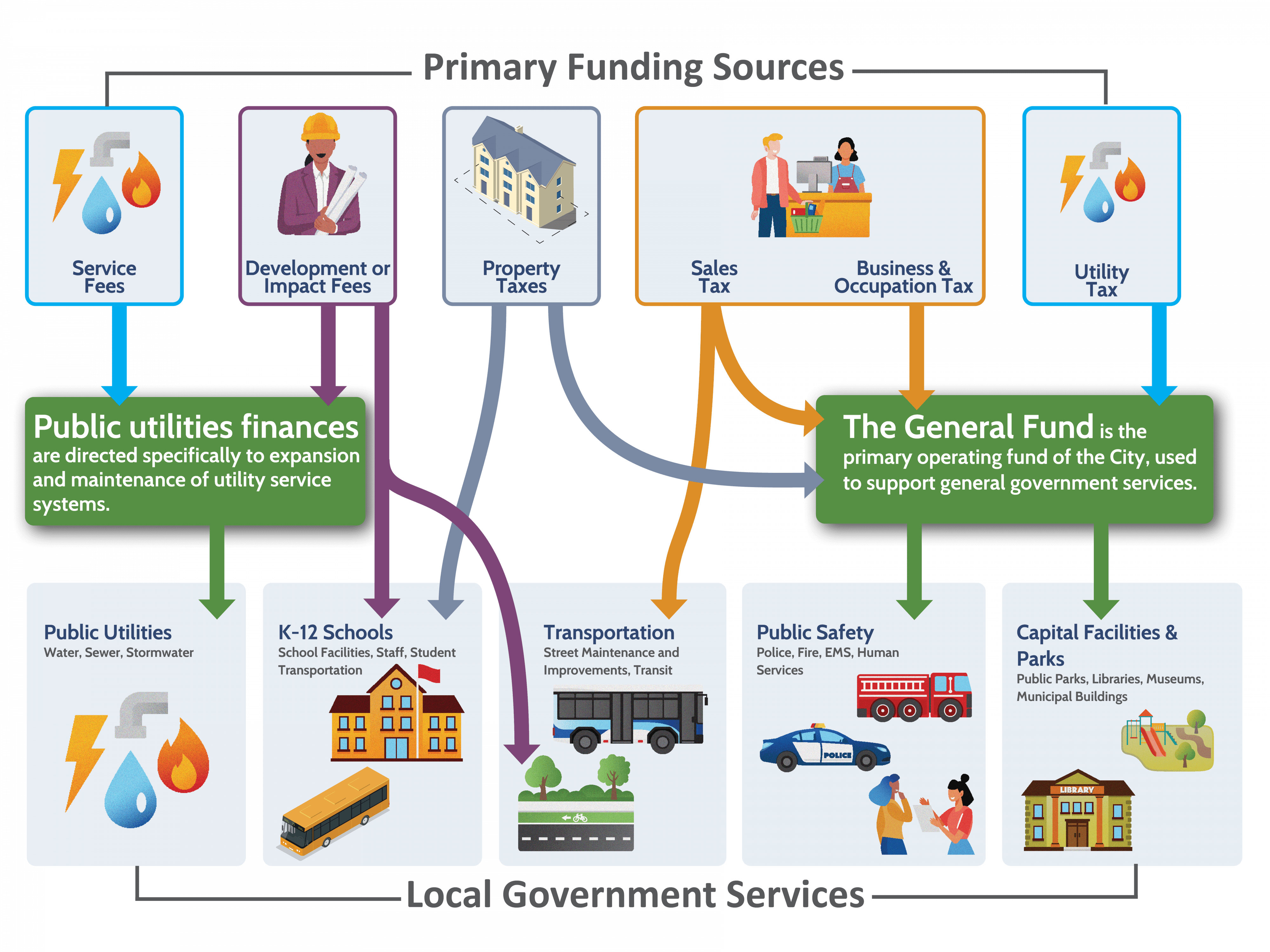

City facilities and services are funded through a complex set of systems. Some of these funding streams are bounded by specific requirements, while others are more flexible.

Property and sales taxes support the daily operations of most local government entities. Bellingham’s General Fund directs some of these revenues to provide public safety, libraries, parks, and other essential services. Some of these taxes are also designated by voters for specific purposes like school construction, affordable housing, criminal justice services, and greenways. Other service fees, impact fees, and utility taxes are collected to support the expansion and operation of facilities and systems benefiting individual properties. These fees vary based on the size and intensity of the activity on each property and its impact on the specific citywide system. For example, a large apartment building accommodates many residents and will pay more for water service and transportation impacts than a single home accommodating just a few residents.

The below diagram summarizes the most common funding streams for planning-related processes.

The diagram below shows that in neighborhoods where homes and businesses are closer together the City can provide the same number of service connections with fewer total miles of roads, sidewalks, pipes, and other infrastructure. Over time this results in significant cost savings for maintenance and operations, shorter daily trips for residents, and fewer impacts on the environment and climate.